Cost of Long-Term Care Services

This page lists the current cost of long-term care services for every state in the country. Click on your state for details on long-term care planning.

Knowing the cost of long-term care in your area can help you decide if transferring this risk to an insurance company makes sense for your situation. Regular health insurance and Medicare do not pay for most long-term care so LTC insurance is critical for many families.

You can choose to transfer the entire risk and pay higher premiums, or some of the risk with lower insurance premiums. Either way, this information can help you to make the best choice for your situation.

Long-Term Care Costs by State – 2024 (annual) | ||||

| NURSING HOME | ASSISTED LIVING | IN-HOME CARE | ||

| LOCATION | Private Room | Private – One Bedroom | Home Health Aide | |

| National Median | $116,800 | $64,200 | $75,504 | |

| Alabama | $96,725 | $49,710 | $52,624 | |

| Alaska | $415,005 | $87,000 | $75,504 | |

| Arizona | $113,150 | $66,000 | $82,368 | |

| Arkansas | $94,900 | $49,752 | $68,640 | |

| California | $158,775 | $75,000 | $84,656 | |

| Colorado | $125,195 | $60,870 | $86,944 | |

| Connecticut | $198,925 | $57,306 | $80,080 | |

| Delaware | $142,715 | $89,100 | $67,496 | |

| District of Columbia | $164,250 | $88,170 | $75,504 | |

| Florida | $136,875 | $57,000 | $68,640 | |

| Georgia | $100,375 | $49,440 | $61,776 | |

| Hawaii | $146,365 | $112,083 | n/a | |

| Idaho | $132,860 | $60,000 | $73,216 | |

| Illinois | $104,025 | $62,700 | $82,268 | |

| Indiana | $116,435 | $60,150 | $80,080 | |

| Iowa | $107,675 | $62,400 | $86,944 | |

| Kansas | $95,995 | $70,200 | $67,496 | |

| Kentucky | $106,945 | $52,014 | $56,056 | |

| Louisiana | $89,790 | $56,997 | $56,056 | |

| Maine | $157,863 | $104,547 | $96,096 | |

| Maryland | $154,030 | $82,800 | $75,504 | |

| Massachusetts | $175,200 | $85,440 | $86,944 | |

| Michigan | $137,605 | $60,600 | $75,504 | |

| Minnesota | $153,665 | $64,200 | $83,512 | |

| Mississippi | $105,120 | $45,600 | $50,336 | |

| Missouri | $78,475 | $58,209 | $91,520 | |

| Montana | $101,470 | $58,890 | $80,080 | |

| Nebraska | $97,090 | $64,782 | $80,080 | |

| Nevada | $148,738 | $60,000 | $68,640 | |

| New Hampshire | $155,125 | $84,300 | $91,520 | |

| New Jersey | $152,388 | $88,800 | $81,224 | |

| New Mexico | $120,085 | $65,400 | $68,640 | |

| New York | $177,755 | $70,200 | $80,080 | |

| North Carolina | $109,500 | $69,225 | $64,064 | |

| North Dakota | $103,113 | $60,600 | $73,216 | |

| Ohio | $114,245 | $63,531 | $73,216 | |

| Oklahoma | $82,125 | $58,650 | $64,064 | |

| Oregon | $182,500 | $69,900 | $60,632 | |

| Pennsylvania | $138,700 | $66,600 | $69,784 | |

| Rhode Island | $162,425 | $69,960 | $91,520 | |

| South Carolina | $112,420 | $55,800 | $73,216 | |

| South Dakota | $106,945 | $64,092 | $96,096 | |

| Tennessee | $111,325 | $58,800 | $73,216 | |

| Texas | $80,300 | $58,980 | $64,064 | |

| Utah | $121,363 | $49,800 | $80,080 | |

| Vermont | $169,725 | $103,620 | $91,520 | |

| Virginia | $122,275 | $72,600 | $68,640 | |

| Washington | $164,250 | $73,650 | $91,520 | |

| West Virginia | $143,445 | $66,000 | $57,200 | |

| Wisconsin | $122,275 | $66,000 | $74,360 | |

| Wyoming | $113,150 | $68,760 | $85,800 | |

Source: Annual cost of care survey conducted by CareScout®, site accessed 03/13/2024.

Nursing Home and Assisted Living rates based on 12 months of care in a private one bedroom. Home Health Aide Services based on 44 hours per week by 52 weeks.

National Long-Term Care Study

This national cost of care survey was conducted by Carescout® and included 429 regions across the country. Over 176,000 providers were contacted by phone which resulted in 11,867 completed surveys of nursing homes, assisted living facilities, adult day health facilities and home care providers.

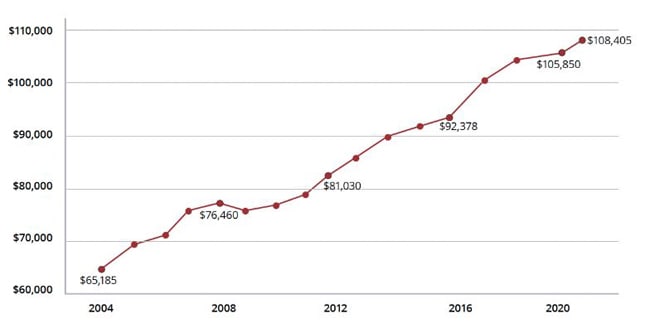

Over the past 20 years, these long-term care surveys have uncovered the inflation rate of long-term care costs. As expected, the cost of all types of care continues to rise — from home care costs to nursing homes. From 2023 to 2024, the cost of care for a Private Room in a Nursing Home rose 4.40%.

The core driver of increases in the cost of care remains supply and demand. Every day until 2030, 10,000 Baby Boomers will turn 65 and seven out of ten of them will need long-term care services at some point. The level of care needed by our aging population has itself increased over the years. There is also an insufficient supply of professionals to meet this growing demand, further increasing the cost of care.