OneAmerica Annuity Care – Long-term care annuity

March 15, 2024

March 15, 2024

Indexed Annuity Care from OneAmerica® is an innovative solution to pay for future long-term care (LTC) costs. It can change the way you think about long-term care planning. Especially if you’ve been thinking about self-insuring the risk.

This long-term care annuity has upside growth potential, combined with LTC benefits and guarantees. The health qualification process is more lenient than traditional long-term care insurance and premiums will NOT increase.

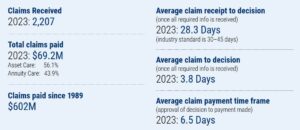

OneAmerica Financial is a mutual company with a strong commitment to their clients. In 2023, they paid over $69 million in LTC Annuity policyholder claims. Learn More >

Explore protecting your assets and family from future LTC costs with a long-term care annuity. We have highly rated companies, multiple plan options, and expert long-term care advisors. Expect personalized service on topics such as:

✓ Suggestions for the product best suited to your situation

✓ Guidance when comparing multiple products and companies

✓ Assistance with health qualifying for coverage

Get started now >

Author: Craig Matesky